Gaydos says Pennsylvania should join its neighbors in eliminating a tax that was first levied here in the 1820s to build canals. Inheritance tax is increasingly affecting ordinary, lower middle class families, especially in the South East. Even further, heirs and beneficiaries in Florida do not pay income tax on any. Ohio and West Virginia are among the many states with no inheritance tax. The good news is Florida does not have a separate state inheritance tax.

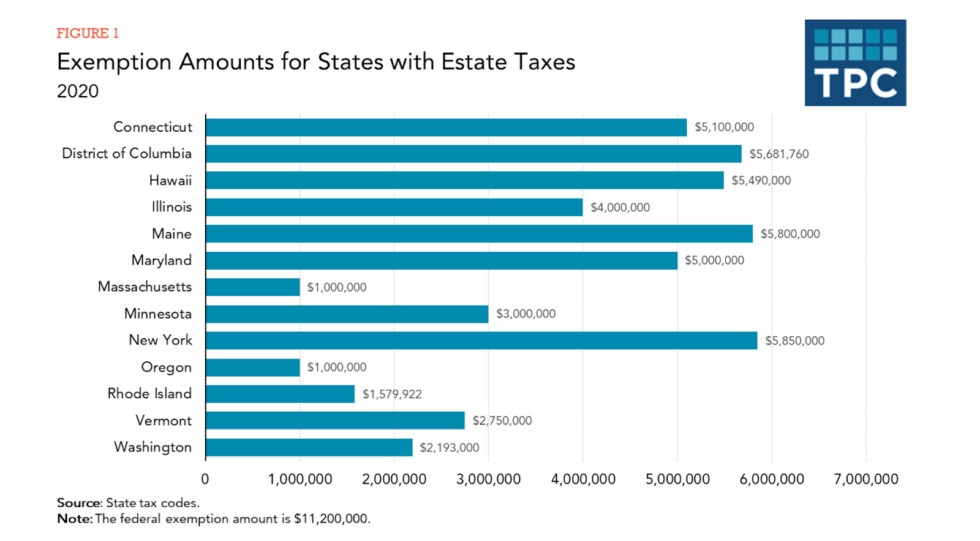

"What we're finding is a lot of parents are buying apartments, small places in Florida to claim as their residency, and then they're staying here, living with their children," says Gaydos. Gaydos says the tax forces older people to move to tax-free states. "You end up having the destruction of the inherited capital because that individual now has to sell off part of the property to pay for something that they weren't initially expecting to have to pay for," Vermeer said. Vermeer says Pennsylvania's tax often requires those who inherit to sell off their loved one's gift to pay the tax. There is no federal inheritance tax and only six states have a state-level tax: Iowa, Kentucky, Maryland, New Jersey, and Pennsylvania. Additionally, Pennsylvania exempted certain agricultural property from. "Eliminating the tax or even reducing it is just the right thing to do to put Pennsylvania in more competitive space with other states," Gaydos said. All other heirs will pay an inheritance tax of 15 percent on all transfers made to them. The California Generation-Skipping Transfer tax shall not apply to the generation-skipping transfers after December 31, 2004.Gaydos says she is, once again, introducing her bill to eliminate the inheritance tax.For gifts made prior to June 8, 1982, the State Controller's Office will continue to collect the Gift Tax.For decedents that died prior to June 8, 1982, the State Controller's Office will continue to collect the Inheritance Tax.For decedents that die on or after June 8, 1982, and before January 1, 2005, a California Estate Tax Return is required to be filed with the State Controller's Office if a federal estate tax return (Form 706) is being filed with the Internal Revenue Service.For decedents that die on or after January 1, 2005, there is no longer a requirement to file a California Estate Tax Return.The information below summarizes the filing requirements for Estate, Inheritance, and/or Gift Tax: Effective January 1, 2005, the state death tax credit has been eliminated. 2 Eleven have an estate tax: Washington, Oregon, Minnesota, Illinois, New York, Maine, Vermont, Rhode Island, Massachusetts, Connecticut, Hawaii, and the District of Columbia. The Economic Growth and Tax Relief Reconciliation Act of 2001, phased out the state death tax credit over a four (4) year period beginning January 2002. Only five states apply an inheritance tax: New Jersey, Nebraska, Iowa, Kentucky, and Pennsylvania. The State Controller's Office, Tax Administration Section, administers the Estate Tax, Inheritance Tax, and Gift Tax programs for the State of California. states levy an inheritance tax on the beneficiary of the estate Iowa, Kentucky, Maryland, Nebraska, New Jersey and Pennsylvania. Home Public Services Tax Information California Estate Tax

0 kommentar(er)

0 kommentar(er)